One of the trusted applications with a wide range of mobile banking options for digital-friendly wealth management including investments, exchanges, cash-outs, and remittances is Revolut. But the challenge is that some exceptional services the e-platform obtains for users worldwide are limited or inaccessible in some countries. That is why people would like to find the excellent Revolute alternative to save funds, cut down on possible fees, and stay pleased with their experiences.

About Revolut: Ins and Outs to Consider

This is a popular e-platform with numerous favorable terms and conditions for its account holders. Sending money like other financial operations is fast and requires zero or minimum fixed charges. This is an absolutely customer-centric banking application with flexible payment backgrounds and worldwide remitting sessions possible for users from many countries.

Among the strongest features the Revolut app can provide consumers with are:

- The availability of investment packages for fiat and cryptocurrencies together with precious metals;

- Low fees worldwide for ATM cash-outs and other transactions for the Revolut card (debit/credit);

- The special Revolut card for kids (Junior) and special-purpose business packages for Revolut Business account holders;

- The most competitive exchange rates compared to other fin-corp applications and e-platforms;

- Minimum fees for payments in foreign currency and fast international money transfers;

- Pretty smart wealth management in the Revolut app with available budget plans, spending analytics, and special money-tracking dashboards;

- The opportunity to create vaults and use other alternative solutions for a better fund-saving experience.

This is the list of the most general perks the Revolut bank can offer to users around the globe. But solid ins are accompanied by some outs to consider. Many users complain about the weak spots this e-platform obtains while failing the main idea of similar fin-corp institutions – to cater to everyone’s financial needs.

For example, Revolut Bank is not considered a licensed banking establishment in many countries. Residents of the UK, USA, and European locations can face limitations in international transactions. This issue is caused by the lack of partnering financial corporations globally to cover all the clients’ requirements concerning money transfer and other needs.

Together with this serious imperfection, the Revolut app can bring the following challenging situations:

- Poor deposit protection because of minimum trustworthiness global partnering financial organizations show to this e-platform;

- Absent account details (history, rewards, and other wealth management options in the application) for residents of many countries;

- Extra charges (about 2%) for ATM cash-out operations if the daily limit of $200 is exceeded;

- Available weekend markup that equals 0.5% for many popular currencies;

- Absent mid-market exchange rates that lead to the high volatility of currency indices in Revolut bank.

Additionally, limitations related to the users’ location usually make it impossible to use most extra services. Those countries that are not Revolut-friendly or consider this digital platform no-licensed cut down all the available packages for users. It means that only standard options are accessible for residents of the locations where Revolut account plans are limited.

It goes without saying that many people are not satisfied with the policies of this banking service provider. The best-matching solution to skip all the above-listed challenges is to find the Revolut alternative.

Why Search for the Revolut Alternative in 2023?

The main reason is to improve your wealth management experience. If you are not glad about the financial options provided by this e-platform, it is high time to explore alternatives and find your perfect match according to your banking needs. For example, standard Revolut plans cannot cater to all the requirements of the average businessman or a typical bank client.

Additionally, local limitations can spoil your remitting experience when the partnering financial establishments are absent and the recipient cannot get the amount of his/her interest. Indeed most Revolut account holders state that premium plan limits are going to erase soon (according to the banking service provider announcements), but the risk of facing more and more challenges is still high.

For example, the list of countries where Revolut money transfer options are not accessible now is rather long:

- New Zealand;

- India;

- Brazil;

- Ecuador;

- Oman;

- The United Kingdom of Great Britain;

- Belgium;

- Italy, etc.

Some legal residents cannot remit funds internationally; another category of users cannot access trade stocks. Germany and Japan are among these countries. The Revolut alternative is required not to be limited to various factors including your physical presence, residence & other payment details.

5 Great Applications to Use Alternatively to Revolut

If you are not satisfied with the Revolut exchange rate or other parameters this e-platform provides consumers with, take a closer look at the list of top applications you can opt for alternatively to the popular digital banking service provider. Among the best-matching variants to take into consideration are:

- Wise;

- Chime;

- Vivid Money;

- N26;

- WealthSimple.

Read the descriptions of these apps to understand their strengths and discover new experiences via alternative options you can count on.

1 – Wise

Many travelers are fond of the financial services this e-platform can offer. Remitting sessions, cash-outs, and other operations will take place here hassle-free and with minimum charges. Local restrictions and limitations are almost zero. It means that almost everyone residing in any country can hold a Wise account.

Multi-currency wallet accessible in the application and a monthly fee for using banking options are not the only reasons to try this digital platform. Wise can become a great alternative to the Revolut account for other reasons:

- Zero overdraft;

- 50 currencies for international remitting sessions and exchanges;

- FACS-insured partners;

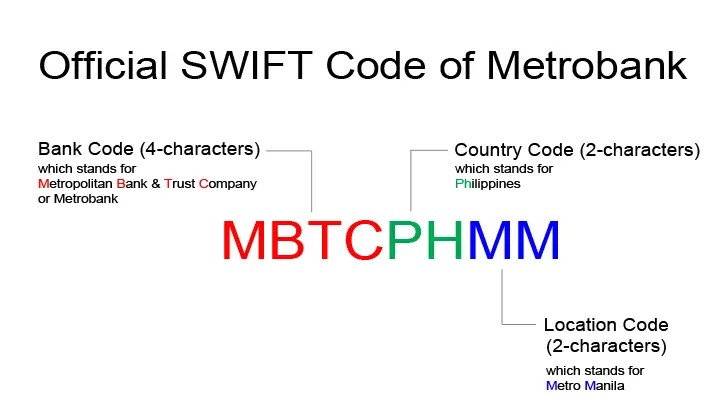

- Bypassing SWIFT transfers via the app-based wealth management options.

Wise offers a plethora of opportunities to those who are not satisfied with accessible Revolut plans. Just discover one more fin-corp digital platform for your needs.

2 – Chime

While taking a look at the Revolut review, most users note unfavorable terms for saving accounts and fund management via the application (especially if the account holder resides in the country with limitations to plans). Chime can become an awesome alternative for these purposes. There is a special-purpose high-yield package for consumers with 2% guaranteed yields (APY).

Additionally, Chime offers the following beneficial options for users’ wealth management and remitting experience:

- Zero monthly fees;

- Smart and user-friendly app interface;

- FDIC insurance is available;

- Social-security-number friendliness;

- Charge-free withdrawals in more than 55.000 ATMs worldwide.

Additionally, there is the interest-free Chime credit card for those who would like to remit funds or cash them out cost-effectively for their budgets.

3 – Vivid Money

This is a great alternative to accessible Revolut money transfer plans. Vivid Money provides free-of-charge requests for potential recipients of international remittances. This e-platform is crypto-friendly and offers access to stocks for investments and exchanges. Note that only EEA residents can use the Vivid Money application.

4 – N26

One more alternative to unfavorable Revolut exchange rate policies is N26. This is the e-platform for EU residents with the main currency for the wallet – the euro. The EU-based banking license allows N26 account holders to please with solid global coverage and numerous partnering financial institutions around the world. As a result, zero charges are for cash-outs in euro and other currencies. Zero fees are for exchange operations and remitting sessions globally.

Be ready to pay for the physical (plastic) card for about 10 euros. A virtual N26 card is free. There are 3 free ATM withdrawals worldwide. Other cash-outs will be at the 1.7% charge from the amount you withdraw. N26 allows free remittances via WISE and other partnering apps covered by the EU license (Revolut money transfer activities do not meet these requirements).

5 – WealthSimple

In comparison with the Revolut review, this e-platform can be a perfect analog for Canadian developers. The digital-friendly banking background presented in the convenient app can cover most users’ needs. For example, the standard plan allows consumers to invest in stocks, exchange crypto for fiats, fiats to crypto, request international remittances, and send money overseas.

Among the most notable strengths of WealthSimple to consider are 1% cashback for all purchases and bookings, private credit investing packages, zero account monthly fees, and numerous on-the-go features for clients.

Summarizing

The question of international remitting operations is still open for most people around the world. Wealth management which is available online is also an actual topic today. That is why most of us are searching for reliable banking institutions and payment platforms that will meet all the expectations and requirements in the context of savings and wire transfers.

If your current account in the Revolut application disappoints with endless challenges, it is high time to explore alternatives to this well-known e-platform. Find the most optimal in this guide through analog applications for your wealth management, excellent remitting experience, and other purposes.