In today’s global economy, the demand for international banking transactions has increased significantly. As more individuals and businesses engage in cross-border activities, having access to accurate and reliable information regarding bank codes becomes crucial. In the case of Banco de Oro (BDO) Philippines, understanding its SWIFT/BIC codes is essential for smooth international financial operations.

What is a BDO SWIFT code?

A BDO SWIFT Code, also known as a Banco de Oro SWIFT Code or BDO International Number, is a unique identification code used by the Banco De Oro (BDO) Bank in the Philippines for international wire transfers. BDO international number serves as an internationally recognized identifier for financial institutions and ensures that funds are transferred securely and accurately.

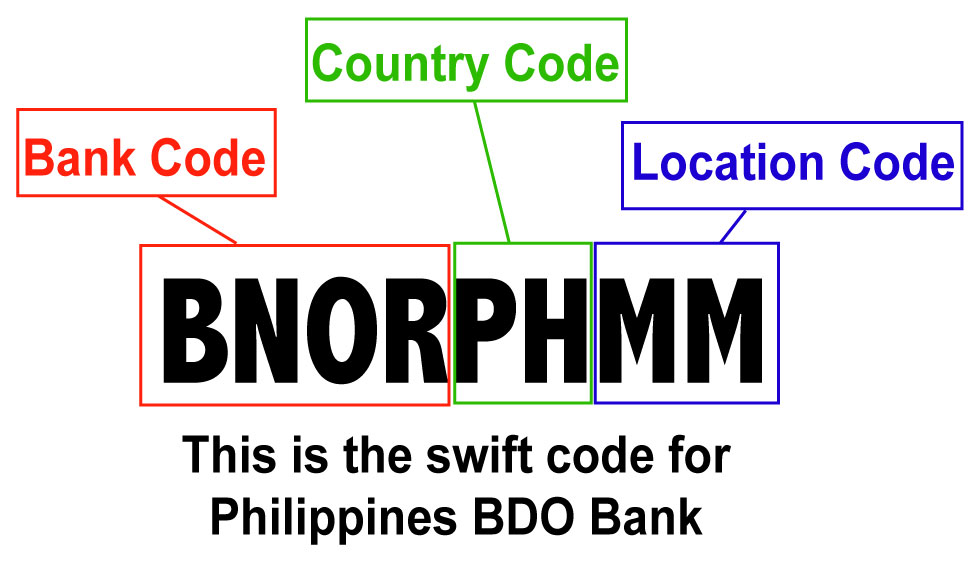

The BDO SWIFT Code consists of either 8 or 11 characters. The first four letters represent the bank’s name – “BNOR” for Banco De Oro Rizal Commercial Banking Corporation (RCBC), which operates under the trade name “Banco de Oro.” The next two letters indicate the country where the bank is located – “PH” represents the Philippines. If there are three additional digits at the end of this code, they signify a specific branch location.

Having access to your recipient’s correct BDO SWIFT Code is essential when sending money from abroad to any account held with BDO bank Philippines. Without it, your transfer may be delayed or even rejected.

To find out what their correct SWIFT codes are, you have several options:

- Visit their official website: you can usually find all the necessary information regarding payments on most banks’ websites.

- Contacting customer service: reach out to them through phone calls, email, or live chat services provided online.

- Use third-party directories: there are numerous online platforms available that provide comprehensive lists of Banks’ SWIFT codes worldwide.

It’s important to note that each branch within a banking institution may have its own unique Banco de Oro SWIFT code; therefore, it’s crucial always double-check before initiating any transaction involving international wire transfers with different branches.

In conclusion, banks use these SWIFT codes during overseas transactions because they allow quick identification while minimizing errors due to human input. Being aware of these details will ensure smooth cross-border transactions without unnecessary delays.

Importance of having correct BDO SWIFT code

When sending money from one country to another, especially involving different currencies, it’s important to use the appropriate Banco de Oro SWIFT code corresponding to your recipient’s bank account. In this case, we’re focusing on Banco de Oro (BDO), one of the largest banks in the Philippines, known for its reliable services and extensive network.

Here are some reasons why having accurate knowledge of BDO’s SWIFT code is vital:

- Smooth international money transfers: using incorrect SWIFT codes can cause delays or even lead to failed transfers altogether. The right BDO SWIFT code Philippines ensures that your funds reach their intended destination efficiently without unnecessary complications.

- Avoid additional charges: by providing accurate information during wire transfers abroad, you can avoid additional charges caused by errors such as wrong routing numbers or invalid BDO codes provided by unreliable sources.

- Security measures: accurate usage of official BDO codes guarantees security against fraudulent activities like unauthorized withdrawals since these codes identify legitimate branches where funds should be sent securely within Philippine territory.

- Compatibility across banks: the correct use of a valid BDO SWIFT Code establishes compatibility between various financial institutions globally during inter-bank transactions involving multiple currencies exchanged through correspondent banking arrangements.

To find out what specific SWIFT/BIC (Bank Identifier Codes) correspond with each branch location under BDO Bank Philippines, it is advisable to visit BDO’s official website or contact their customer service for accurate and up-to-date information.

In conclusion, when sending money internationally to a bank account located in the Philippines through online transfers, including wire transfers or international money transfer services like Western Union or MoneyGram, having knowledge of the correct BDO SWIFT Code is vital. It ensures timely and secure transactions without any complications while also saving you from unnecessary charges that may arise due to errors caused by incorrect BDO codes.

Remember always to double-check your recipient’s banking details before initiating a transaction; this small step can prevent potential setbacks and ensure peace of mind throughout the process.

Finding your specific branch’s SWIFT code

Finding your specific branch’s BDO SWIFT code Philippines can be done through various channels:

- Official website: visit https://www.bdo.com.ph/ and navigate their “Branch Locator” page to search by city/town name.

- Customer support helpline: contact their customer support helpline directly if you need assistance finding your specific branch’s SWIFT code.

- Online banking platforms: if you have online banking access with BDO Philippines already set up on your account(s), log in to this platform, where they typically display these details prominently alongside other relevant account information.

Commonly used BDO Philippine SWIFT codes

Here are some commonly used BDO SWIFT codes for different purposes:

- BNORPHMMXXX: this is the primary SWIFT code for Banco de Oro Universal Bank, used when conducting general banking transactions with BDO Philippines.

- BNORPHMMPAS: the Pasig Ortigas Center branch of BDO has a unique SWIFT code to identify its location specifically.

- BNORPHMMEQC: this particular BDO SWIFT code Philippines should be utilized for clients who need to transact with Equicom Savings Bank (a subsidiary of Banco De Oro).

SWIFT/BIC code components: a guide for online money transfers in the Philippines

The SWIFT network facilitates secure communication between banks globally, enabling them to efficiently process international financial transactions. It operates through a standardized messaging system that utilizes unique identification codes known as BICs. These alphanumeric codes are assigned by SWIFT and play a crucial role in identifying both the sending and receiving banks during wire transfers.

When initiating an international money transfer from your bank account in the Philippines, there are certain steps involved:

- Find out if your bank supports online international money transfers: while most major Philippine banks offer this service nowadays, ensure that your chosen institution provides easy access through their Internet banking platform or mobile app.

- Verify exchange rates and fees: before proceeding with any transaction, compare different options provided by various banks regarding exchange rates offered and applicable fees associated with transferring funds internationally.

- Choose the best online platform/provider: conduct thorough research on which provider offers seamless integration of BDO SWIFT BIC code details while ensuring maximum security measures over digital platforms.

- Provide the recipient’s complete information:

– Account number/IBAN (International Bank Account Number): to initiate an overseas transfer successfully, make sure you have accurate account details of the recipient party.

– Beneficiary name: ensure spelling accuracy to avoid potential issues during processing.

– Receiving the bank’s full name/address/SWIFT code/bank/branch location – The precise location details assist in routing payments correctly without delays or errors. - Verify transaction amount limits imposed by your bank: depending on the type of account you hold, specific limits may apply to online money transfers. Be aware of these restrictions and plan accordingly.

- Initiate the transfer process:

– Log in to your bank’s Internet banking portal or mobile app.

– Select “International Money Transfer” or a similar option.

– Fill out all required fields with accurate information, including SWIFT/BIC code details for both sending and receiving banks. - Review transaction summary: take a moment to review the provided information before confirming the transfer. Double-check that all entered data is correct, as mistakes can result in delays or potential loss of funds.

- Track your transaction: once initiated successfully, most banks provide tracking facilities allowing you to monitor the progress of your international money transfer until it reaches its destination safely.

When comparing different options for online money transfers within the Philippines, consider factors such as exchange rates offered by different providers along with any rewards programs they might have. Some institutions offer incentives such as cashback or point accrual systems that can benefit frequent transmitters significantly.

It is important to focus on immediate cost savings and prioritize security measures implemented by financial institutions handling these transactions. Ensure that adequate encryption protocols are utilized during every step involved in initiating an international money transfer from a current/savings account via wire transfers.

Benefits and limitations

BDO SWIFT BIC codes provide numerous benefits that simplify international financial transactions:

- Efficient transactions: using accurate and up-to-date information, funds can be transferred SWIFTly from one account to another, regardless of geographical location.

- Global reachability: with an extensive network worldwide, customers can access their accounts securely while engaging in cross-border activities such as investments or business expansion plans.

- Flexibility in currency conversion: processing payments through a global platform allows conversions between currencies at competitive rates.

However, it is essential to note some limitations associated with using BDO BIC codes:

- Dependency on correspondent banks/intermediaries: when sending money internationally via wire transfer, intermediary banks may impose additional fees or foreign exchange charges during routing processes before reaching the final destination account holder.

- Cost implications & exchange rate fluctuations: international transfers often incur costs beyond what local transactions entail due to correspondent bank involvement and possible currency conversion requirements. Additionally, exchange rates can fluctuate between the time of initiation and completion.

Conclusion

Understanding BDO BIC codes is vital for individuals or businesses engaging in international banking transactions with BDO Bank Philippines. The correct BDO SWIFT code Philippines ensures that funds are transferred accurately and efficiently across borders, minimizing delays and avoiding unnecessary fees.

By utilizing the available resources such as BDO’s official website, customer support helpline, or online banking platforms to find specific branch SWIFT codes when needed, customers can enjoy seamless global financial operations while leveraging on competitive currency conversion rates offered by Banco De Oro Limited Bank’s network worldwide.