The need for quick and secure international money transfers has become increasingly important. Whether you are sending or receiving funds from another country, having the correct TD bank identification code is crucial to ensure a smooth transaction. This quick guide will provide an in-depth look at TD bank SWIFT codes and how they work (by the way, take a look at the top ways to send money to India).

TD Bank: More Info

TD Bank, one of North America’s largest banks with a strong presence in both Canada (under TD Canada Trust) and the United States, offers online banking services that make it convenient for customers to send and receive money internationally. To facilitate these transactions smoothly, TD Bank provides its customers with unique TD Canada trust SWIFT codes, which are often called TD bank identification codes.

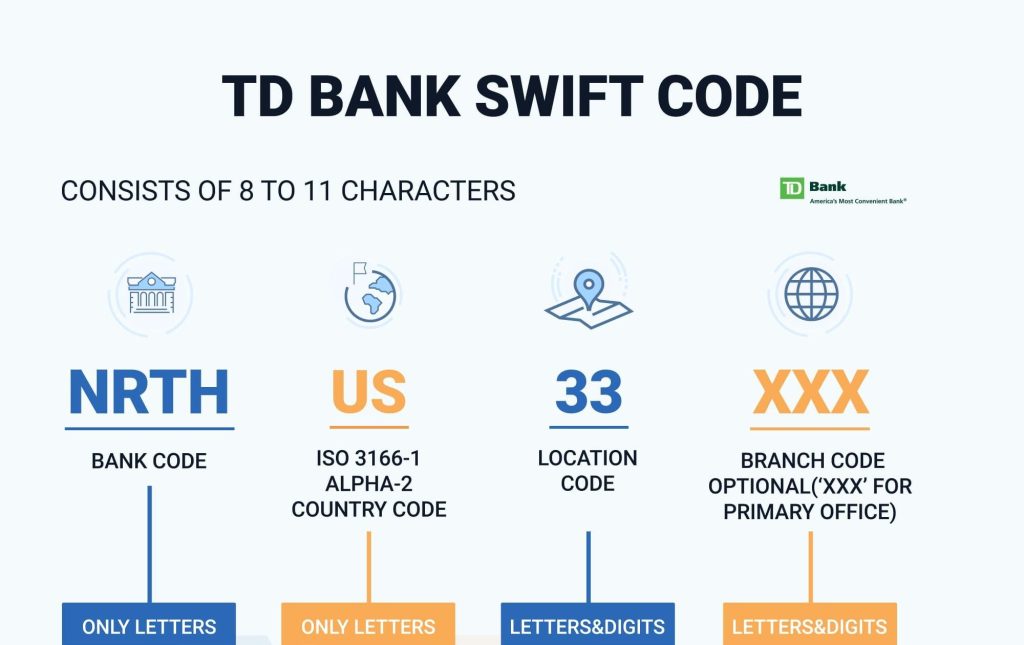

A TD bank SWIFT code is also known as a BIC code TD bank (Bank Identifier Code). It consists of eight or eleven characters that identify specific financial institutions worldwide. For example, if you want to transfer funds into your TD checking account from overseas using wire transfer services, you would need to provide the sender with your branch’s specific TD SWIFT code. Without the TD bank wire address, the transfer won’t be possible; that’s understandable.

To find the appropriate TD bank SWIFT code for your account type – whether personal or business – all relevant information can be found on their website under “Wire Transfer Instructions.” Here, you’ll find instructions on where wires should be sent (TD bank address for wires) and corresponding addresses based on different countries’ requirements.

By providing accurate information such as recipient name(s), IBAN number(s), routing numbers (if applicable), and TD bank address for wires details, including postal/zip codes – clients can initiate safe cross-border transactions through various methods like direct debit card payments immediately after confirming successful completion via virtual confirmation notifications received instantly upon authorization by respective parties involved ensuring real-time tracking capabilities while maintaining utmost privacy throughout this process too!

TD Bank SWIFT/BIC Codes: Let’s Look Closer

The Toronto-Dominion Bank (TD Bank) employs the SWIFT/BIC code TD bank TDOMCATTTOR for seamless international transactions. When funds are being sent from the United States to TD Bank, it is crucial for the sender to provide additional details related to TD’s correspondent bank in the U.S., Bank of America. The pertinent information includes an ABA number, specifically 026009593, and a SWIFT number, denoted as BOFAUS3NXXX.

This supplementary information ensures a smooth and accurate transfer process, facilitating the secure movement of funds across borders. The ABA number serves as an identifier for the American banking system, while the SWIFT number uniquely identifies Bank of America in the global financial network.

If you find yourself in need of TD Bank’s SWIFT/BIC code, chances are you are either engaged in the process of sending money to Canada from abroad or anticipating the receipt of funds into your TD Bank account from an international source. Rest assured, providing the correct SWIFT/BIC code and additional details will help streamline the transaction, ensuring a prompt and efficient financial exchange.

Sending Money to Canada

When sending money to a TD account in Canada from an international location through your local bank, it’s important to be aware that the transaction could incur higher costs than necessary. This is often due to fixed international bank transfer fees, unfavorable exchange rates, and additional correspondent banking fees that can accumulate rapidly. We confidently advise against using your bank to send money to Canada.

Furthermore, transactions conducted via the SWIFT network (using a SWIFT code TD bank), commonly utilized for bank transfers, tend to have extended processing times, averaging between one and five business days. This makes them less favorable if you require a SWIFT transfer.

Fortunately, more intelligent alternatives are readily available. Opting for a digital money transfer provider not only has the potential to save you up to 95% in fees compared to traditional banks but also allows for quicker transfer times to your beneficiary’s TD account. This ensures a more cost-effective and expedited process for sending money internationally.

Receiving Money From Abroad

If you’re waiting for money from another country and they’re asking for your TD Bank SWIFT/BIC code, keep in mind you might get less cash than you should. That’s because the other bank could slap on high fees and not-so-great exchange rates.

For example, a typical U.S. bank might take 5% to 10% in fees when sending $1,000. So, instead of getting around C$1,259 (the regular rate), you could end up with just C$1,100 – that’s C$100 less!

But here’s a smart move to save money when getting cash in Canada from abroad: use the Wise Account, for example. It works for individuals and businesses and gives you local bank details for ten different currencies, including Canadian dollars. With Wise, you can handle your money like a local, getting fair exchange rates and low fees. It’s a handy online account that makes receiving money from abroad simpler and more cost-effective.

How to Make An International Wire Transfer With TD Bank: TD Bank Wire Instructions

To initiate an international wire transfer with TD Bank, you’ll need to follow these TD bank wire instructions:

- Visit a TD bank branch:

– For both domestic and international wire transfers, a visit to a TD Bank branch in person is required, as online options are not available. - Locate nearest branch:

– Use the bank locator to find the nearest TD Bank branch.

– Schedule an appointment to ensure a smooth process. - Gather necessary information:

– Prepare the essential details for providing TD Bank with your international wire instructions. - Required information for transfer:

– The recipient’s name.

– The recipient’s address.

– The recipient’s bank account number or IBAN.

– The full name and address of the recipient’s bank.

– The recipient bank’s SWIFT/BIC number. - Additional inquiries:

– Inquire about TD Bank’s wire transfer limits to ensure your transaction complies.

– Ask about any intermediary bank fees that may apply during the transfer.

– Check on the current exchange rates if applicable. - Know the transfer details:

– Be aware of the amount you intend to transfer and specify the currency. - Consult with a teller:

– Visit the bank at your scheduled appointment and speak with a teller.

– They will guide you through the process, ensuring all necessary information is provided accurately.

Remember that TD Bank’s in-person approach is designed to prioritize security and accuracy in international wire transfers. If you have any specific questions or concerns, the bank staff will be able to assist you during your visit.

Money Transfer Services to Consider Instead of TD Bank

Sending money internationally has become a common need for many individuals and businesses. While traditional banks like TD Bank have long been the go-to option for these transactions, there are now numerous alternative money transfer services that offer convenience, competitive rates, and faster processing times (and no TD SWIFT code needed). Whether you’re looking to send funds abroad or receive them from overseas, it is essential to explore all available options before settling on one service.

To help you make an informed decision about which money transfer service suits your needs best, we have compiled a list of reliable alternatives to consider instead of relying solely on TD Bank:

- Wise (formerly TransferWise): Known for its transparency and low fees, Wise offers some of the most favorable exchange rates in the market while ensuring secure transfers worldwide. With their peer-to-peer system bypassing international banking networks altogether in certain cases, users can save significantly on conversion costs.

- PayPal: Widely recognized as a trusted platform for online payments globally since its inception in 1998; PayPal also provides convenient cross-border fund transfers with competitive foreign exchange rates compared to traditional banks such as TD Bank.

- Revolut: A digital bank offering multi-currency accounts with free currency exchanges at interbank rates up until a specific monthly limit applicable depending upon your account type chosen – Revolut allows seamless global transactions without hidden fees associated with conventional institutions.

- Xoom: As part of Paypal’s suite of financial services specifically tailored towards international remittances, Xoom stands out by guaranteeing fast delivery times, even within minutes if needed, through partnerships with various local payment providers around the globe.

- Western Union: Established over 150 years ago, primarily serving telegraph communication purposes during earlier days when electronic fund transfers were unimaginable – Western Union evolved into providing instant cash pickups across thousands of agent locations worldwide alongside mobile wallet deposits, allowing easy access to the recipient’s end, too.

- WorldRemit: A fast-growing digital money transfer service available in over 150 countries, it offers a wide range of options for sending and receiving funds, including bank deposits, mobile wallet top-ups, cash pick-up locations, and airtime transfers.

- Remitly: Focused on serving immigrants who send money back to their home countries regularly; Remitly provides competitive exchange rates along with convenient delivery options such as direct bank deposits or cash pickups at partner locations overseas.

- Azimo: With attractive fees combined with an intuitive user experience via website or app – Azimo stands out by providing seamless transactions within minutes across many areas worldwide while offering multiple payout methods tailored towards local preferences wherever possible – ideal for individuals supporting family members abroad.

- OFX (formerly OzForex): Suitable more for larger international transfers like property purchases or business-related payments requiring personalized solutions; OFX ensures competitive rates and dedicated customer support throughout the process to meet specific requirements efficiently.

- TransferGo: Geared towards low-cost remittances primarily targeting expatriates living in Europe wanting affordable ways of sending small amounts periodically without compromising security levels associated with large commercial banks’ reputation globally.

All of these options are good for sending money to India and other countries. Remember that each provider has its strengths depending on factors like transaction speed, cost-effectiveness, and convenience features offered alongside regulatory coverage protecting customers’ interests during fund transmissions internationally.

By exploring the alternatives instead of solely relying on traditional banking channels such as TD Bank when transferring funds internationally – you can potentially save both time and expense while ensuring your hard-earned money reaches intended recipients quickly and securely, too! Nevertheless, TD bank remain a nice option as well. Now, as you know a lot about TD Canada trust SWIFT codes, you can utilize the services of this bank much more conveniently.